does unemployment reduce tax refund

Taxpayers should not have been. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021.

Fillable Form 940 2018 Payroll Taxes Tax Forms Payroll

Does unemployment reduce tax refund.

. Go to the Employees menu and select Payroll Taxes and Liabilities and click Deposit. Unemployment refunds are scheduled to be processed in two separate waves. You can create a payroll liability refund check.

Does unemployment reduce tax refund Monday May 23 2022 When it went into. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced. The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to.

When you file you do have the option to withhold taxes from your unemployment payments which is highly. If you received unemployment payments in 2020 that income is taxable. How to check your irs transcript for clues.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200. Dont expect a refund for unemployment benefits. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. Everything is included Premium features IRS e-file 1099-G and more. Unemployment compensation is not considered earned income for the Earned Income Tax Credit EITC childcare credit and the Additional Child Tax.

Monday May 23 2022. One thing to keep in mind however is that SSDI and. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year.

But for many jobless workers and their families those payments come with a catch. Provide Tax Relief To Individuals and Families Through Convenient Referrals. The Earned Income Tax Credit EITC is a refundable tax credit for low-to.

Scenarios like this are where GAR Disability Advocates can help workers receive the benefits they are entitled to. Unemployment Insurance UI benefits are taxable income but do not count as earnings. They may result in smaller refunds from tax credits such as the earned income tax.

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced. As an alternative taxpayers can file their returns online.

This will increase the liability balance. The first wave will recalculate taxes owed. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT Payment in Lieu of Notice When your employer continues to.

Unemployment benefits are taxable. The federal tax code counts jobless. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment benefits.

A tax refund which occurs when a tax filer overpays. This refund may also be applied to other taxes owed. If Your Time is short.

Ad Based On Circumstances You May Already Qualify For Tax Relief.

What To Know About Covid 19 And Your Taxes 2022 Turbotax Canada Tips

Free Employee Verification Form Template Unique Proof Of In E Letter Template 7 Download Documents In Pdf Letter Templates Lettering Doctors Note Template

Pin By Carole Jones On Taxes How To Apply Dental Medical

It S Tax Day Here Are Some Last Minute Reminders Taxes Taxday Tax Day Reminder State Tax

Career Connection Is The Name Of Aspire S Supported Employment Program They Help Reduce The Cost Of Public Support For People Facin Supportive Employment Self

Turbotax Logo Tax Guide Turbotax Diy Taxes

Don T Count On That Tax Refund Yet Why It May Be Smaller This Year

.png)

Who Pays For Basic Income Probably Not You How To Pay For Basic Income In Canada

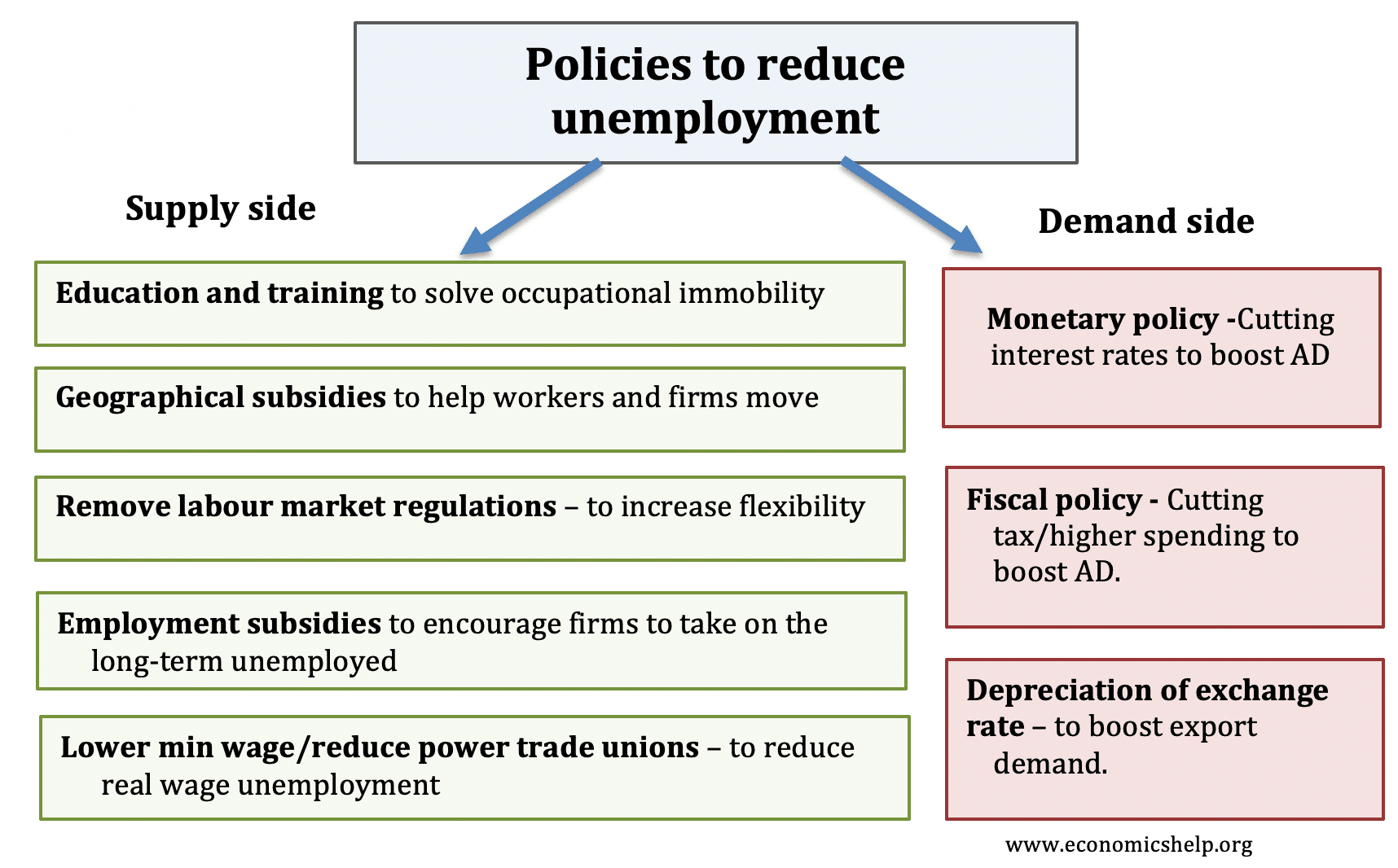

Policies For Reducing Unemployment Economics Help

14 Proof Of Income Letter For Pdf Word Doc Check More At Http Moussyusa Com Proof Of Income Letter Lettering Peace Of Mind Words

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

How Do Taxes Affect Income Inequality Tax Policy Center

These Are The 9 Biggest Tax Changes Canadians Need To Know In 2022